Untaxed capitals : the areas with the most tax-dodging drivers

The UK postcodes with the most tax dodging drivers

Share:

Copied to clipboard

There are many costs associated with car ownership, from the initial cost of buying a car, to fuel, car insurance, MOTs and car maintenance. However, there’s one additional expense that is often overlooked when tallying up the costs of running your own motor, and that is getting your vehicle taxed.

If your car is going to be on public roads, whether being driven or just parked outside your house, it will need to be taxed. Otherwise, you could be in for a nasty shock when the DVLA gets in touch with you.

This made us wonder just how prevalent car tax evasion is across the country. After a little digging, we can reveal how many enforcement actions for untaxed vehicles occurred in 2020 in every UK postcode. Read on to discover which parts of the country has the highest number of are the biggest offenders, and which areas are best at following the rules.

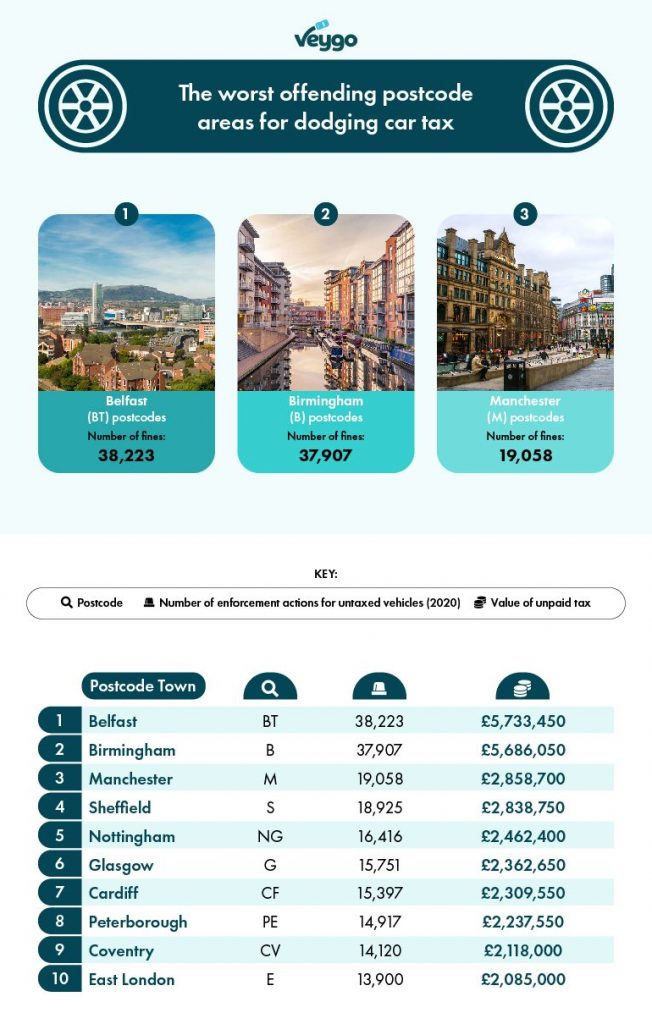

The worst offending postcode areas for dodging car tax

Here we can see the ten postcodes with the highest number of fines for untaxed vehicles, as well as the approximate value of the unpaid tax. Did your postcode make the naughty list?

1. Belfast (BT) postcodes Number of fines: 38,223

The postcode with the highest number of enforcement actions for untaxed vehicles is BT, which is used for all of Belfast and Northern Ireland. Here, there were 38,223 fines which equate to £5,733,450 of unpaid vehicle tax. As one of the largest postcodes, it stands to reason that the BT area would be high up on the list, but that’s still a tremendous amount of missing taxes!

2. Birmingham (B) postcodes Number of fines: 37,907

B postcodes found the Birmingham area has the second-highest number of enforcement actions, totalling 37,907 in 2020. Again, Birmingham’s BT postcode area is one of the largest in the country population-wise so a high result was to be expected, but the value of unpaid taxes is still a whopping £5,686,050.

3. Manchester (M) postcodes Number of fines: 19,058

In third place is Manchester’s M postcode, which saw 19,058 enforcement actions over the course of last year. This translates into £2,858,700 of unpaid vehicle taxes which, while notably lower than the top two offenders, is still a shockingly large sum of money.

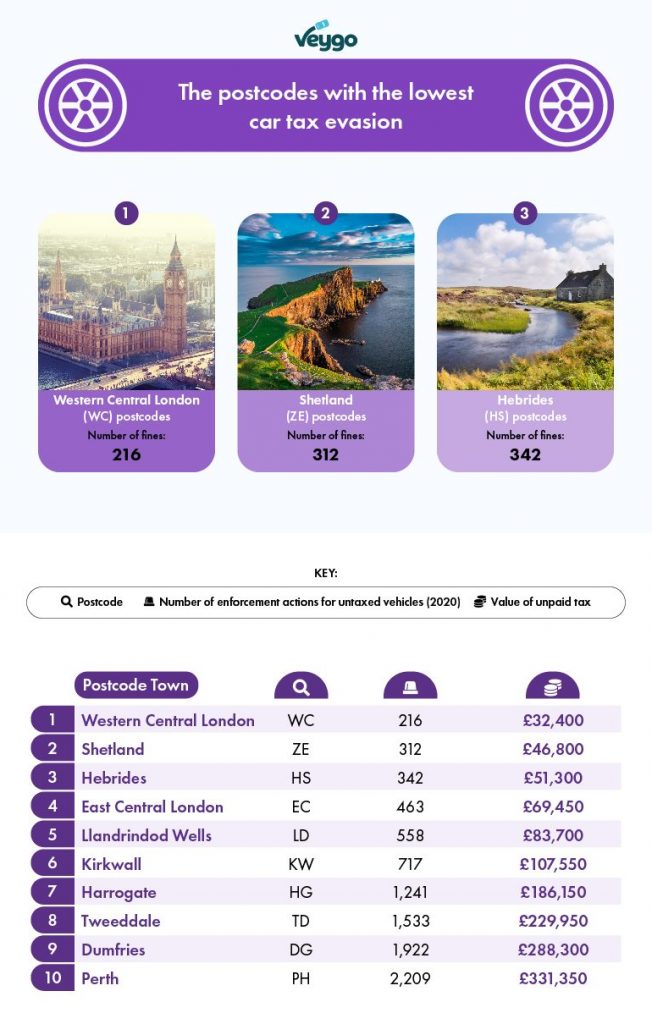

The postcodes with the lowest car tax evasion

On the other hand, there are some postcodes that see very few enforcement actions for untaxed vehicles, but where in the country are they?

1.Western Central London (WC) postcodes Number of fines: 216

The WC postcode of Western Central London saw the fewest enforcement actions for untaxed vehicles of anywhere in the country, with just 216. This is not a hugely surprising result as Western Central London has a relatively small population and the availability of public transport in the centre of the capital means fewer people need to run their own vehicle.

2. Shetland (ZE) postcodes Number of fines: 312

Shetland’s ZE postcode had the second-lowest number of enforcement actions in 2020 with 312. This remote and sparsely populated part of the UK does not have many drivers, which may at least partially explain why the total value of unpaid car tax only reached £46,800.

3. Hebrides (HS) postcodes Number of fines: 342

Another remote part of Scotland, the HS postcode of the Hebrides, had 342 enforcement actions for unpaid car tax, the third-lowest in the country. The total value of these unpaid taxes sits at £51,300.

The UK’s Untaxed Capitals, by population

Having looked at the areas with the most fines for untaxed vehicles, we next wanted to see which postcodes are the biggest offenders when comparing the number of offences to each area’s total population. Here we can see the total number of enforcement actions per 1,000 residents in each postcode.

1.Worcester (WR) postcodes Fines per 1,000 residents: 27.90

Worcester is the UK’s car tax-dodging capital with the most enforcement actions per head of anywhere in the country. In 2020 there were 27.90 fines given out per 1,000 residents in the WR postcode, putting it well ahead of even second place.

2. Luton (LU) postcodes Fines per 1,000 residents: 22.06

In second place is Luton, with LU postcodes receiving 22.06 fines for having untaxed vehicles per 1,000 residents. Here the total value of unpaid car tax is £1,111,650.

3. Romford (RM) postcodes Fines per 1,00 residents: 21.02

Taking bronze, with 21.02 fines per 1,000 people is the RM postcode of Romford. The total value of unpaid taxes in this town on the outskirts of East London is £1,629,300.

The UK postcodes that dodge the least car tax, by population

Finally, we’ve also found the postcodes with the smallest number of car tax fines per head. Here are the areas that are most reliable when it comes to paying their vehicle tax.

1.Western Central London (WC) postcodes Fines per 1,000 residents: 6.00

The WC postcode of Western Central London not only had the fewest enforcement actions of anywhere in the country but also had the smallest number per head, with only 6 fines for every 1,000 residents.

2. Harrogate (HG) postcodes Fines per 1,000 residents: 8.97

The North Yorkshire town of Harrogate’s HG postcode claims second place with only 8.97 fines for unpaid car tax per 1,000 residents. The total value of unpaid tax here is £186,150, which equates to £1.35 per head.

3. York (YO) postcodes Fines per 1,000 residents: 9.38

Another North Yorkshire area, the YO postcode of York, takes third place with 9.38 fines per 1,000 people. The value of all unpaid car taxes in the area is £791,100, which translates to just £1.41 per person.

Taxing your car in UK

If you’re planning on driving a vehicle on public roads, or even just parking it on the street, then it needs to be taxed. This is a legal requirement, and not doing so can land you with some pretty uncomfortable repercussions. Failure to pay your vehicle tax will usually result in an £80 fine, though you can receive a 50% discount if you pay within 28 days. If you don’t pay the fine, you could then be charged up to £1,000 and could even have your vehicle seized.

Thankfully, paying your car tax is a simple and straightforward process. Simply visit the government website and enter your vehicle’s details. You will then be prompted to pay the appropriate rate of tax for your vehicle, which can vary considerably depending on the age or value of the car, whether it uses alternative fuel, or if it is a high emissions vehicle.

However, despite how easy the payment process is for taxing your car, many people still take to the roads in untaxed vehicles. There are some instances in which this is allowed, such as driving to a pre-booked MOT, but many people try to get away without paying their tax when they should.

As vehicle tax is now a completely digital process, with paper tax discs being scrapped a few years ago, people who don’t pay are almost guaranteed to get caught. So, don’t think you can try and play the system. Tax your vehicle or pay any fines as soon as possible and you’ll save yourself a lot of bother in the long run.

What does car tax pay for?

The tax you pay to drive your vehicle on public roads goes into a central government fund which helps to pay for various infrastructure and local projects. These can include anything from building new roads, tunnels and performing maintenance such as widening roads and fixing potholes, to funding public libraries and museums, maintaining parks, and paying for street lighting.

Paying your UK car tax

You can pay for car tax in the UK in three different ways. The cheapest of these is to pay it annually in a single lump sum. If this isn’t a problem financially, then this method of payment is not only the most affordable, but also means you don’t have to keep remembering to pay at more regular intervals.

You can also pay your car tax in six-month periods, or in monthly installments via Direct Debit. These options are slightly more expensive but are good options if you don’t have the immediate funds to pay for a full year’s tax. They are also great options if you only intend to use your vehicle for a few months.

When do I not need to pay car tax?

If you don’t intend to drive your car at all on public roads then you don’t need to have it taxed. Instead, you can register a SORN (Statutory Off-Road Notice) for your vehicle which lets the government know that your vehicle will be kept off the roads and is therefore exempt from tax and insurance requirements.

However, as soon as it goes on a public road, even if it’s just parked there, then it will need to be taxed. The option not to tax your car is mainly used if your car is in storage for a lengthy period of time.

So, don’t get caught out driving without tax or you could end up with a hefty fine! Remember that there are ways of making car tax easier to pay, and if you’re not using your vehicle make sure you register a SORN and avoid paying tax when you don’t need to.

We’ve got a whole article that explains when you should SORN your car if you’re looking for a bitt more info on this.

Methodology

We wanted to find out which parts of the country are the worst at paying for their vehicle tax, and which are the best. To do this, we sent a Freedom of Information Request to find out which postcodes in the country received the most enforcement for untaxed vehicles. This allowed us to compare every postcode in the country by the number of fines for having an untaxed vehicle on public roads.

We then calculated the potential value of these unpaid taxes. We used the base rate of vehicle tax, which in 2020 was £150, and multiplied it by the number of enforcement actions. This gave us an idea of the total value of unpaid vehicle tax in each postcode.

Lastly, we calculated the number of enforcement actions in each postcode per 1,000 residents using 2011 census data retrieved from Wikipedia and Public Health Scotland. This allowed us to give a more nuanced view of the distribution of unpaid vehicle taxes which took into account the varying populations of each postcode.

Share:

Copied to clipboard

I'm the social and content executive at Veygo and have been driving for 5 years. I love driving and the freedom it gives you!