How to compare temporary car insurance

Temporary car insurance can be helpful for loads of different occasions; whether you’re borrowing a car from somebody else or picking up short-term insurance for your own car.

With a number of different options out there, it can be hard to know how to decide on which company to go with. We’re going to cut through the insurance jargon and run through how to compare temporary car insurance.

Comparing temporary insurance: can you book in advance?

It’s great being able to pick up insurance when you need it and hit the road straight away.

But if you love to plan ahead, you may want the option to book in advance. Some temporary

insurers don’t allow you to book in advance so it’s worth checking out before you decide on the best temporary insurance for you. With our short-term insurance you can choose to buy the moment you need it, or you can book cover in advance.

Which temporary insurance has driving curfews?

Some temporary insurers will have curfews in place meaning you can’t drive late at night.

The devil is in the details, so it’s worth checking all the insurance policy information before deciding on the best temporary insurance for you.

With our temporary cover, there’s no curfew on insurance policies that are 24 hours or more. That means you’re free to drive whatever time you’d like. Go on, go and enjoy that late night drive-through.

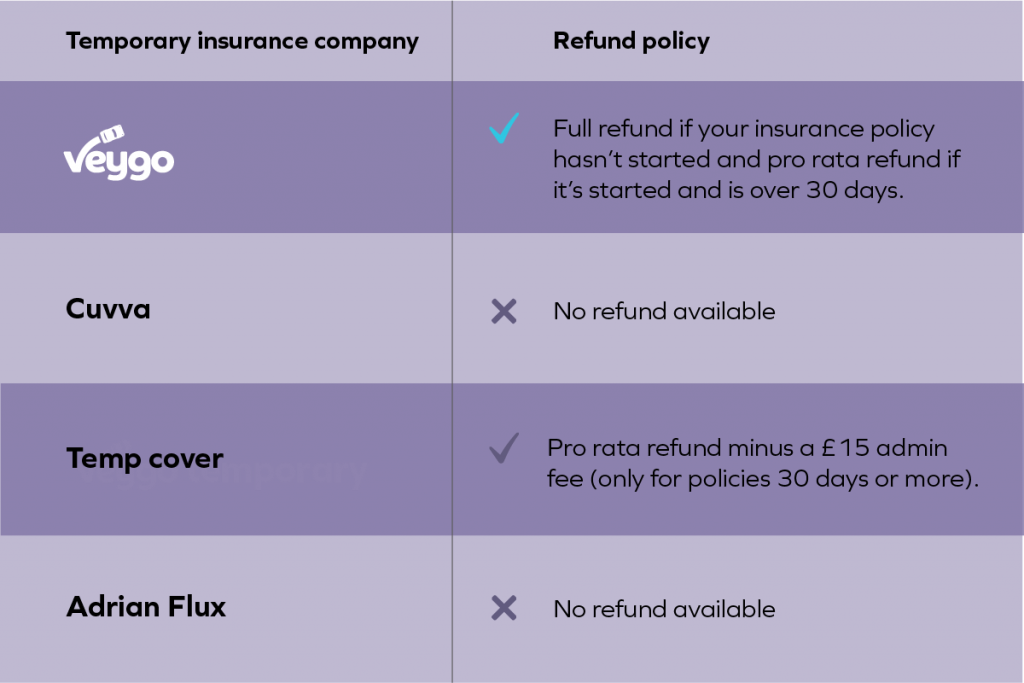

Cancellation and refund policies

Sometimes, things don’t go to plan and you may end up wanting to cancel your temporary insurance. It’s a good idea to check the FAQs of different temporary insurers to find out their cancellation policies.

With our temporary car insurance for example, if your policy hasn’t started yet, you can

easily log into your account to cancel and get a full refund. If you’ve started your policy we’ll recalculate the price based on a shorter policy and refund the difference.

Check out our Help Centre for more information.

With Cuvva, you won’t be able to get a refund your temporary cover. With Temp Cover, you can’t get a refund if your policy is less than 30 days. If your policy is more than 30 days, they’ll refund the premium paid minus a pro rata refund and the administration fee of £15. With Adrian Flux, you won’t be able to get a refund on your temporary cover.

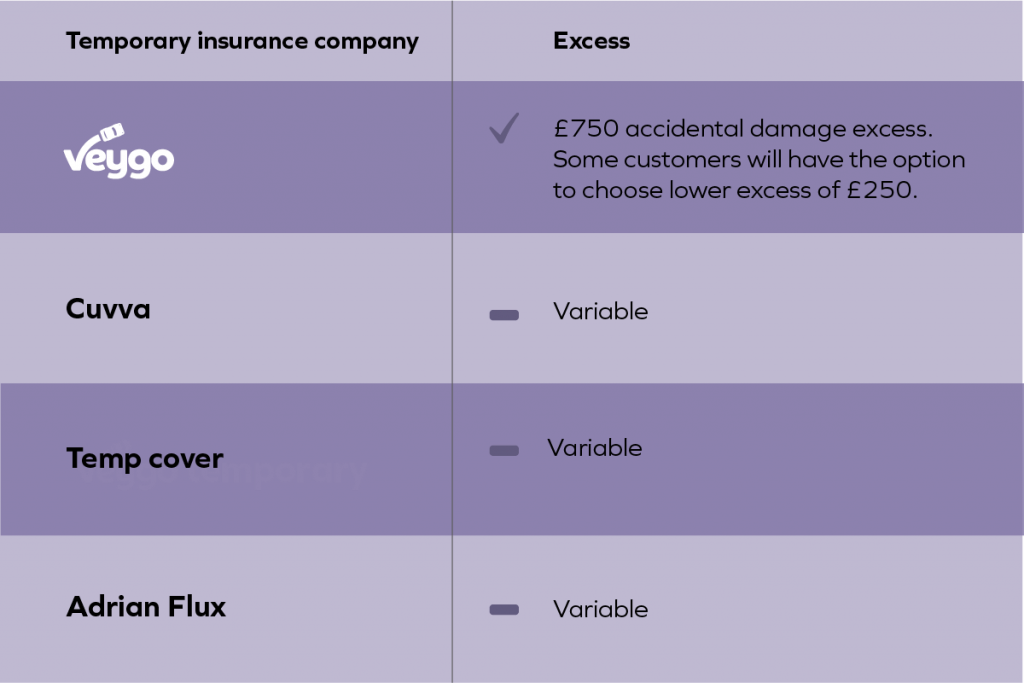

Temporary car insurance excess

Car insurance excess is the amount you’d have to pay towards a claim you make on your insurance policy, or the amount that’s held back by your insurance company. If you choose a higher car insurance excess, the price of your insurance is likely to be lower; but you’ll have to pay out more if you end up having to make a claim. Check out our guide to car insurance

excess for more information.

Some people prefer a higher excess, while others would prefer to choose a lower excess. Whatever your preference, it’s a good idea to check insurance policy details and make sure you get what you’re after from your temporary cover.

Our accidental damage excess is set at £750 and some customers can choose a lower

excess of £250 depending on some general information about you and your car.

With Cuvva and Temp Cover excess is variable depending on your quote.

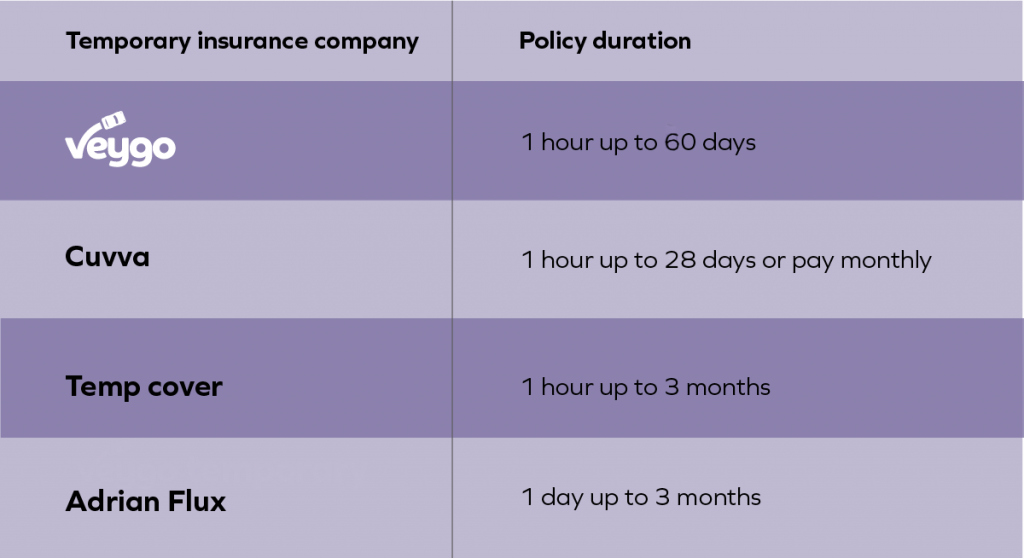

Temporary insurance durations

How long do you need temporary insurance? If you just need to pop out quickly, you might only need insurance for an hour. Not all temporary insurers offer hourly insurance so it’s worth checking out your options as you don’t want to be overpaying for something you may not even potentially use, finding the best time frame for your needs could lead to a cheaper insurance policy . Similarly, you may want to get monthly insurance if you need the car for a bit longer.

Veygo temporary insurance is available from as little as 1 hour up to 60 days.

Cuvva temporary insurance is available from 1 hour up to 28 days; or they offer subscription

cover where you pay monthly.

Temp Cover temporary insurance is available from 1 hour up to 3 months.

Adrian Flux temporary insurance is available from 1 day up to 3 months.

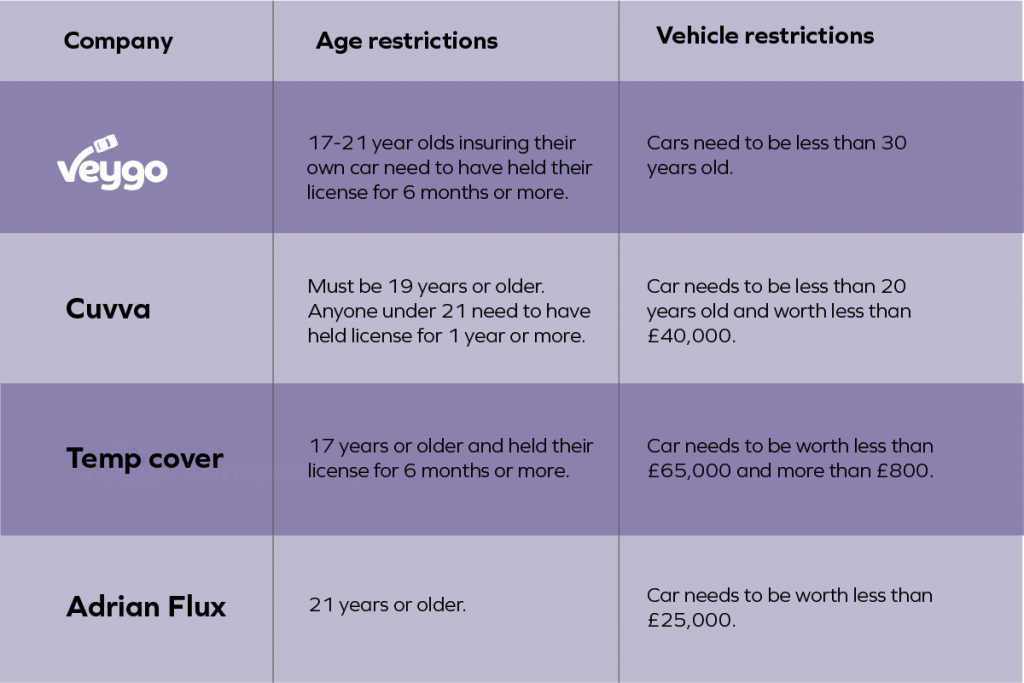

What are the restrictions?

Every temporary insurance company will have different rules about who they’ll actually

insure. Generally this will include restrictions on your age and the age or value of your car. For example, a lot of temporary insurers won’t cover anyone under 21 years old.

With our temporary insurance, we cover people who are 17 years old or older to

borrow someone else’s car. If you’re getting insurance on your own car and you’re between 17 and 21, you’ll need to have held your license for at least 6 months. We also don’t insure cars that are more than 30 years old, so if you’ve got a bit of a golden oldie, you’ll have to go elsewhere.

At Cuvva, they’ll insure people who are 19 years or older, but if you’re under 21 you’ll need

to have held your license for a full year. They don’t insure cars that are more than 20 years old or worth more than £40,000.

At Temp Cover, they’ll insure people who are 17 years or older, as long as you’ve held your licence for at least 6 months. They don’t insure cars that are worth more than £65,000 or less than £800.

At Adrian Flux, they’ll insure people who are 21 years or older with temporary insurance. They don’t insure cars that are worth more than £25,000.

Customer service

different temporary car insurance brands. For example with our temporary insurance, 91% of people say enquiries are handled effectively.

No impact on the owner’s no claims bonus

With most temporary insurance companies, if you’re borrowing a car from someone and need to make a claim, it won’t impact the owner’s no claims bonus. Amazing!

However, it’s always worth double checking how the insurance policy will impact the owner before deciding on who to go with.

So, thinking ahead, make sure you get cover that best suits you, as later down the line this could be the leading factor to cheap temporary cover!

Finding the cheapest temporary car insurance

There are lots of things to consider when it comes to finding cheap short-term insurance. But we know that for most people, the price will be a deal breaker.

The cost of insurance varies depending on lots of different factors and every temporary

insurer will have a different way of calculating your price. There are some price comparison websites for temporary insurance.

However, it’s not going to have all potential options so you may be missing out on the

cheapest temporary car insurance for you.

Your best bet is to get a list of short-term insurance brands that you trust and get a quote

from each one. With our temporary insurance, you can get a quote in minutes to find out exactly how much it will cost you.

What’s the best temporary car insurance?

So, it all depends on what you’re looking for. We hope we’ve helped you with how to

compare temporary car insurance so you can choose the best option for you. Happy driving!